The story of laser manufacturing in 2023 and beyond looks to be one of continued growth in spite of lingering economic headwinds from pandemic recovery, supply chain challenges, and the general economic volatility of recent years.

What trends and changes in the laser manufacturing industry are likely in 2023?

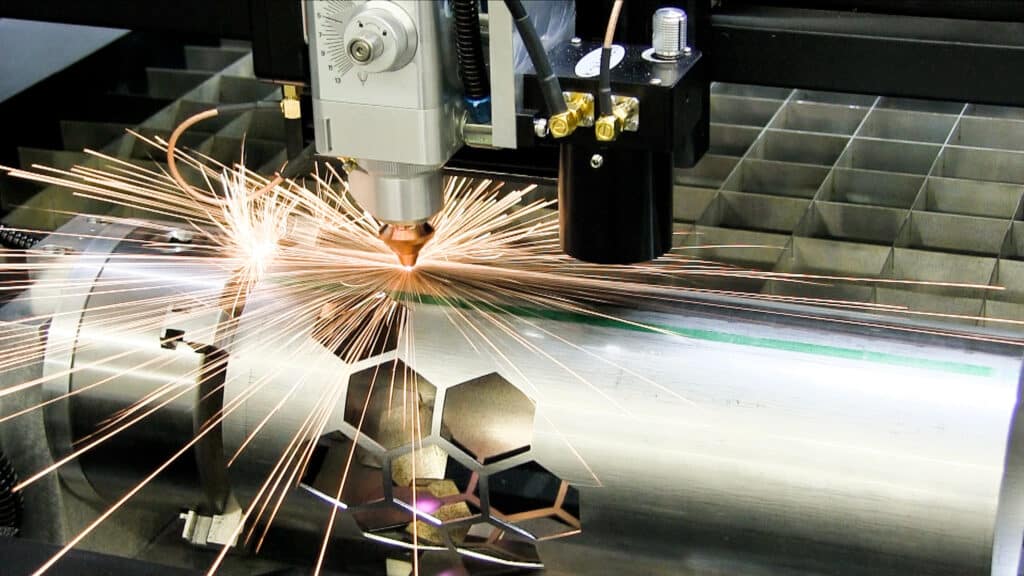

The fiber laser industry is predicted to grow by approximately 880 million dollars between 2022 and 2027, with a compound annual growth rate (CAGR) of 11.05%, according to a market report summary by PRNewswire, available from Yahoo. This report notes increasing demand for high-powered fiber lasers due to the many purposes they serve. (We offer a fiber laser in the form of our FiberCELL, an integrated 1–3kW laser system built into a high-quality safety enclosure.) A related report analyzing the tunable laser market predicts market growth of approximately 530 million dollars in the tunable laser sector during 2021–2026.

Manufacturers continue to recover from the impact of the COVID-19 pandemic as 2022 draws to a close, and this recovery should continue in 2023. The ongoing conflict between Russia and Ukraine, and global policy responses to it, have also had rippling effects throughout many areas of the world economy, from prices of fuel to the availability of certain parts.

Although the onset of the COVID-19 pandemic in 2020 caused demand for lasers to dip in North America, the previously cited fiber laser market report notes demand was increasing again by the second half of the year, and the North American market is now predicted to account for about 30% of fiber laser market growth by 2027.

Although the onset of the COVID-19 pandemic in 2020 caused demand for lasers to dip in North America, the previously cited fiber laser market report notes demand was increasing again by the second half of the year, and the North American market is now predicted to account for about 30% of fiber laser market growth by 2027.

According to a recent guest editorial in FFJournal, shortages and supply chain challenges can be expected to continue into 2023 and even 2024, although in the U.S., some steps have been taken that could help to soften the impact of these problems, such as the passage of the CHIPS and Science Act, which aims to incentivize manufacture of computer chips and microprocessors in the United States.

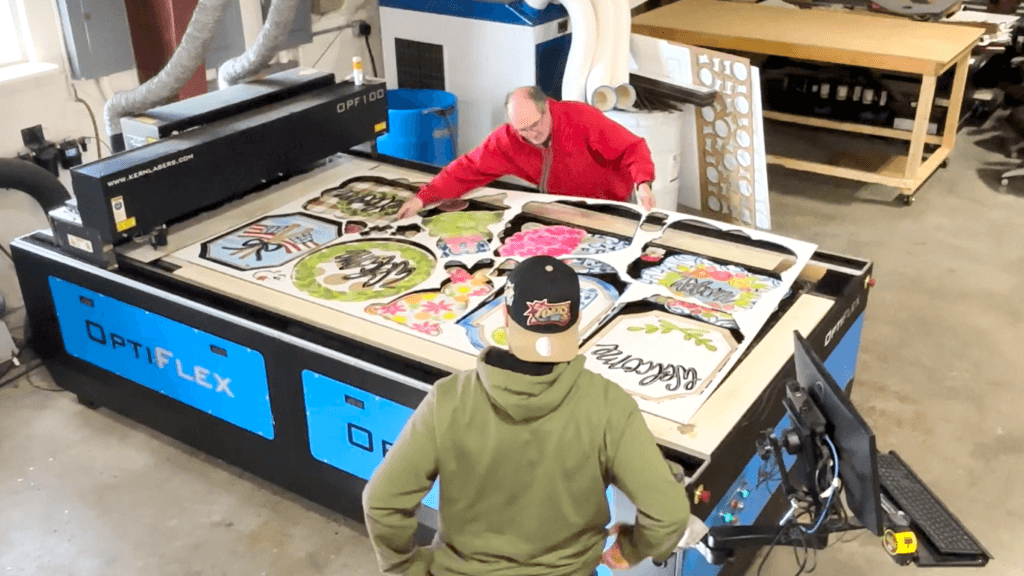

Another article in FFJournal notes one response from some manufacturing businesses to supply chain difficulties has been the practice of near-shoring or re-shoring their offshore production work—bringing production back home, or at least closer to home, and mitigating or eliminating layers of logistical complexity. At Kern Laser Systems, we’re also fighting shortage issues. Thankfully, we’ve been able to continue delivering machines within a 6-12 week lead time.

A current piece of sponsored content on The Fabricator’s website advertising an upcoming webcast about on-site nitrogen generation for laser cutting operations illustrates this desire to simplify manufacturing logistics in the laser cutting industry. Generating nitrogen on-site would be an alternative to taking deliveries of nitrogen for these businesses.

What does this all mean for end-users?

As in any year, in 2023 laser cutting operations will continue to upgrade and adjust their shop equipment and work processes in competition with one another, adopting the latest products offered by laser manufacturers. This competition between businesses that use lasers spurs competition between the businesses that make them.

A recent article in The Fabricator provides details of how Indiana metal fabricator Southwest Welding has continually upgraded the laser technology in their shop over time., with modern fiber lasers allowing the shop to cut aluminum faster and with less dross, and increased automation allowing them to operate machines overnight. In the article, employee Lyle Martin notes, “Laser cutting has really exploded the capabilities of what we can do, especially compared to waterjet cutting or stamping.”

Although laser cutting, engraving, and manufacturing technologies have been around for several decades at this point, lasers and laser systems are technologies that remain in constant development, and the advances made by producers of laser technology directly impact the efficiency of the companies and individuals that use these products for their businesses.

Multiple recent briefs in The Fabricator highlight product introductions of high-quality entry-level laser cutting systems and cost-efficient fiber laser cutting systems in the fourth quarter of 2022. We just introduced our own KT300 and KT500 CO2 model lasers, which improve upon and replace our existing KT250 and KT400 models after we made a number of modifications that enabled a higher output power from the lasers.

In an ideal world, product innovation drives up the level of performance a user can get out of a lower-priced product, and it also simultaneously drives down the price of admission for professional quality equipment; however, in our real world, of course, there are more complex forces at play, and laser equipment customers may continue to feel the impact of 2022’s high inflation in laser prices.

In addition, even as inflation starts to ease, prices of equipment could remain high. If more laser manufacturing companies and even manufacturers in adjacent businesses do bring production home to the United States, this could result in more high-quality laser products hitting the market, which is good for the consumer, but manufacturing in the U.S. also tends to result in higher prices in addition to higher quality. That’s why we commit ourselves not only to building the highest quality lasers we can, but also to selling them for the best prices we can—and that commitment remains evergreen at Kern, no matter what year it is.